August 16, 2022

July 2022 SBA 504 Funding Rate:

The real estate 504 rates decreased this month. The 25 year and 20 year rates both decreased by 8 bps from the month prior. The 10 year equipment rate increased 4 bps from the last funding, 2 months prior.

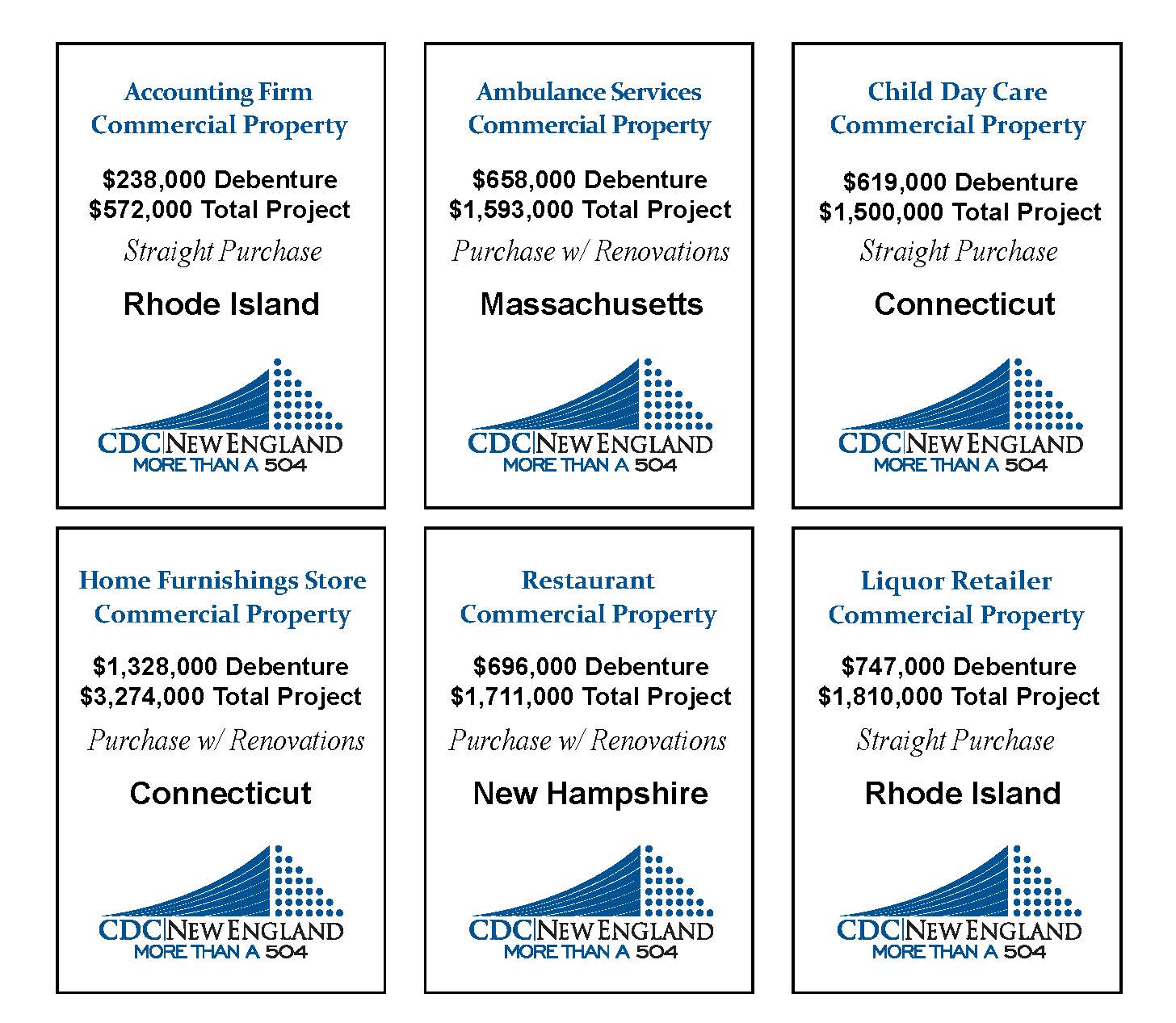

Recent SBA 504 Deals from CDC New England:

SBA 504 Term Loans:

- Long-term loans for purchasing land and buildings, new construction, renovation and leasehold improvements, machinery & equipment

- Lowest cost; low rate fixed for 10, 20, or 25 years

- Down payment financing, if needed

- Bridge financing available

*Note Rate 3.975 + 1.3475 servicing spread (25 years)

*Note Rate 3.870 + 1.3475 servicing spread (20 years)

*Note Rate 3.556 + 1.3475 servicing spread (10 years)

*For Loans Approved After 10/01/21

Contact CDC New England:

Paul F. Flynn, Jr., President & CEO

(781) 928-1133

(617) 921-2695 (cell)

Mike Topalian, Managing Director

(781) 928-1122

(508) 612-5661 (cell)

Dave Raccio, Senior VP of Sales & Marketing

Territories: Connecticut, Western Massachusetts & Vermont

(860) 218-2901

(203) 780-1097 (cell)

Carol Brennan

Territories: Massachusetts, Connecticut, & Rhode Island

(781) 928-1123

(413) 237-6648 (cell)

Nancy Gibeau

Territories: Massachusetts, Connecticut, & Rhode Island

(508) 254-7891 (cell)

Ryan Johnson

Territories: Massachusetts & New Hampshire

(781) 928-1132

(617) 762-6708 (cell)

Matt Brothers

Territories: Central/Western Massachusetts, Vermont, Connecticut, & New Hampshire

(781) 928-1124

(603) 512-3411 (cell)

Lauren Angat

Territories: Connecticut, Western Massachusetts, Vermont, & Southern New Hampshire

(860) 299-6025 (cell)